If you itemize deductions on schedule a your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married filing separately.

Rv sales tax deduction 2019.

Whether you own an rv or travel full time in an rv figuring out rv related tax deductions can be a huge challenge.

According to turbo tax the irs publication 936 states a home includes a house condominium cooperative mobile home house trailer boat or similar property.

You should be aware of rv tax write offs for rv owners as well as tips and tricks for applying and getting the biggest rv interest deduction.

Rv tax deductions home mortgage interest deduction.

Instead look at it as a lifestyle choice.

What s new for 2018.

If you financed your rv you might be able to take the interest as a mortgage interest deduction.

The tax cuts and jobs act modified the deduction for state and local income sales and property taxes.

For anyone with a domicile state without an income tax the sales tax deduction especially with the purchase of a large item such as an rv or car truck might be the way.

You don t want to miss out on these rv tax deductions that could save you a lot of money.

Ryan is a full time rver and an enrolled agent and bookkeeper at tax queen llc.

Only about 30 of taxpayers do that.

The basics of what qualifies for the deduction haven t changed.

First things first don t buy an rv for a tax deduction.

But large purchases like an rv often incur enough tax to tip the balance in favor of the sales tax deduction.

Love your rv depending on the size and features of your rv you may be able to count it as a second home and write the interest off on your taxes.

For the tax year 2019 with your tax return due by april 15 2020 the standard deduction is 12 200 for single taxpayers and 24 400 for married couples filing jointly.

Most take the standard deduction so that needs to be examined closely by your professional tax advisor.

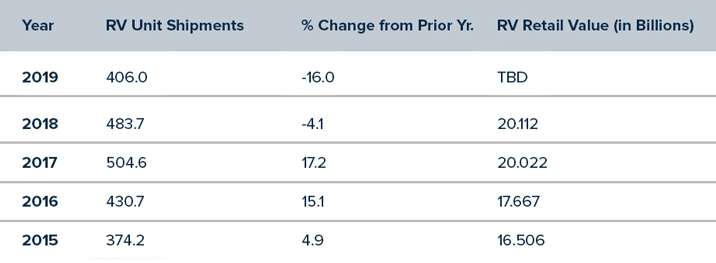

Rv sales tax by state.

However that doesn t mean there aren t a few rv tax deductions available to those who rv.

This deduction can be a major boon for part time rvers come tax season.

It also depends on the tax rate and your personal income.

Typically in a year you purchase an rv or even a car truck you might qualify for the sales tax vs.

Once in a while there s a silver lining at tax time.

Rv tax deduction 2020.

Rv tax deduction 2019.

7 rv owner tax tips 2020 update.

As an rv owner you re entitled to rv tax reduction.

We don t know.

One more thing before we let you go.

You can still deduct state and local sales or income tax along with real and personal property taxes.

Keep in mind that all filers are eligible to take the standard deduction which gives you a certain amount of tax leeway without itemizing other deducted items.

You would only want to itemize if your total deductions are more than the standard deductions.